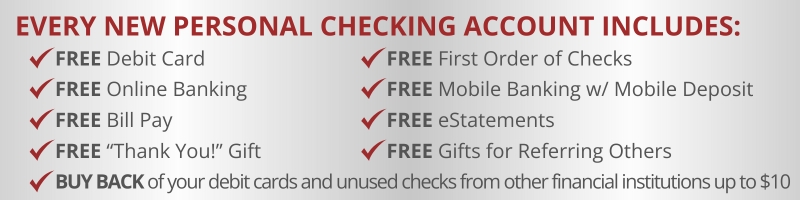

Other fees such as non-sufficient funds, overdraft, etc. may apply. See fee schedule for details. Minimum opening deposit is only $50. Ask us for details. Bank rules and regulations apply. Offer good on personal accounts only; ask us about our outstanding options for your business or organization. Free gift may be reported on a 1099-INT or 1099-MISC. Free gift provided at the time of account opening. Up to $10 for debit cards and unused checks from another financial institution given at the time the checks/debit cards are presented.

Benefits Checking: Offer good on personal accounts only. $10,000 Accidental Death and Dismemberment Insurance coverage is provided at no additional charge. Total coverage splits evenly among all authorized signers as indicated on the account opening signature cards. Insurance products are not deposits, not FDIC insured, not insured by any federal government agency, not guaranteed by the bank.